Most of us dream of early retirement. We imagine a life with the freedom to enjoy non-work activities full-time, like traveling, fun hobbies, and spending more time with family and friends.

Achieving retirement requires decades of hard work, saving, and careful planning. Ryan Gan, a senior majoring in statistics and a minor in financial computation and modeling and in data science at Rice University, investigated whether leveraged Exchange Traded Funds (ETFs) could be a key to early retirement.

“In planning for retirement, most people contribute money to personal retirement accounts and a 401K, and they manage investments themselves. Portfolios often include index funds that track broad market indices, such as the S&P 500,” said Gan, who quantitatively analyzed three leveraged ETF strategies using historical stock price data from 1965 to 2024 to determine the optimal ratio to balance risk and reward.

“The S&P 500 tracks the stock performance of 500 leading companies listed on the U.S. stock exchange with historical returns of 10 percent a year. Through this project, I wanted to determine if leveraged ETFs can amplify returns without excessive risk.”

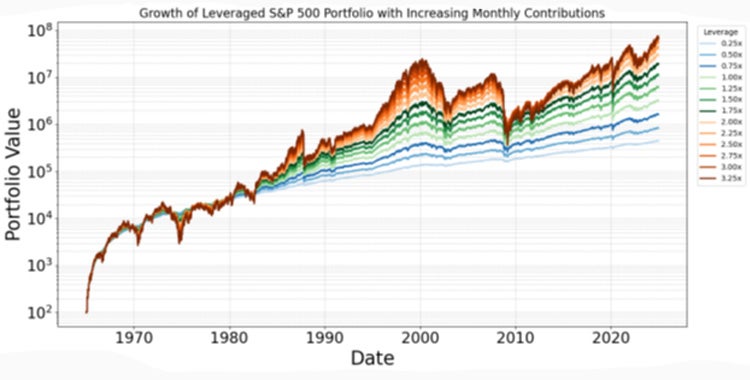

The results from his investigation, which have been published in CoFES’ White Paper Series, show that highly leveraged portfolios are risky for the average investor, but if one has a longer investment timeframe, such as 30-40 years, slightly leveraging up an investment portfolio would give increased returns with limited risk.

The paper was the final element of his STAT 450 Senior Capstone Seminar project with Associate Teaching Professor Elizabeth McGuffey. Statistics Professor Chad Shaw and Arya Muralidharan, a doctoral student in statistics, also served as Gan’s project advisors. Shaw is also director of the Data to Knowledge Lab, which provides data science experiential learning opportunities where students learn by working with complex, real-world data sets.

Leveraged ETFs use financial derivatives and debt to amplify the daily returns of an index, such as the S&P 500, or other assets such as bank swaps, futures contracts, and options strategies.

In his paper, Gan says, “A 2x leveraged ETF would multiply the S&P 500’s daily returns by 2, so a 1% increase in the price of the S&P 500 becomes a 2% increase in the price of the leveraged ETF.”

The double-edged sword, Gan says, “Is a 1% decrease in the price of the S&P 500 becomes a 2% decrease in the price of the leveraged ETF.”

Gan said, “Because the stock market increases over time, investing in leveraged ETFs could allow one to reach their retirement goals faster. However, a leveraged ETF could struggle to recover due to how stock market returns work, especially during a significant market downturn or crash.”

For the first part of his analysis Gan, backtested an initial $100 investment plus monthly contributions of $100 into the S&P 500 from 1965 to 2025 with leverage values from .25x to 3.35 in increments of .25. He created a function in Python to calculate the Extended Internal Rate of Return (XIRR) formula to get the true returns, as it accounts for the monthly cash flows put into the portfolio.

To simulate future stock market returns data and see potential outcomes of returns, Gan used bootstrapping and Monte Carlo simulation techniques.

For bootstrapping, he resampled historical S&P 500 daily returns data with replacement and applied the returns for different leverage levels and investment lengths of 20, 25, 30, 35, and 40 years for 1000 simulations for each of these combinations to assess the range and distribution of possible outcomes.

In the Monte Carlo simulation, he simulated future returns by drawing from a probability distribution by assuming that returns follow a normal distribution with a specified mean and standard deviation.

“This method offers greater flexibility, as we can modify the mean and standard deviation to model potential future market scenarios,” Gan said.

Additionally, Gan says, “Analysis with Monte Carlo could be used to consider dynamically leveraging the portfolio over time, which could be from either hedging the amount of leverage against market volatility or decreasing the amount of leverage as one nears retirement.”

As a recent graduate of Rice University who is now a business analyst at McKinsey & Company’s Houston office, Gan's senior capstone study also sheds personal light on his retirement planning.

- Shawn Hutchins, Communications and Marketing Specialist